Netflix shares have dropped by 25 percent, which is more than $110, during late night trading.

Although net income came in slightly higher than projected for third quarter revenue, subscriber growth took a hit. Net income came in around $84 million, which is a 38 percent increase and higher than projected, but this increase is not from new subscribers.

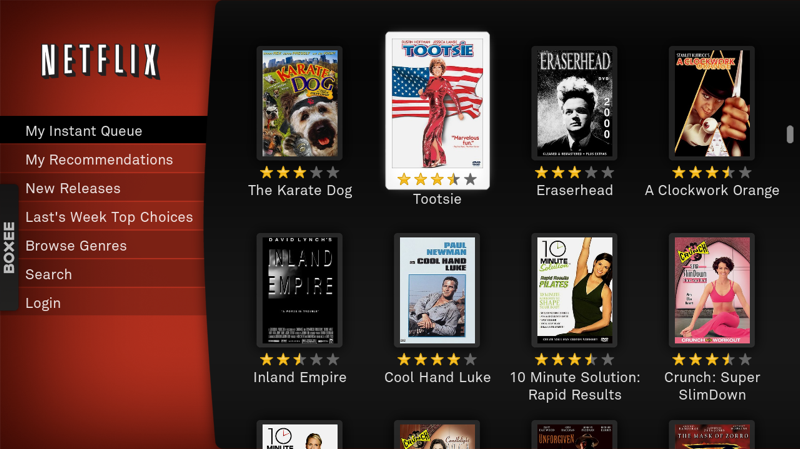

Netflix raised their monthly subscription price from $8.99 to $9.99, which some believe may have contributed to a decline in subscriptions. In addition, HBO is releasing a new streaming program that may have taken some of the former Netflix subscribers.

HBO's new standalone service will allow subscribers to watch the networks programming without a cable subscription. Little information has been announced about the details of this new service such as; How much will it cost? Will it compare to HBO Go? Will it really offer all promised programming? Will you need additional items in order to stream this content? Though these questions go unanswered, enough information was given that some people are ready to sign up and leave Netflix in the past.

In July, Netflix projected to add 3.69 million subscribers, 60 percent of them being from outside the US. However, they only added 3 million and of those 3 million, 67 percent of them came from outside the US but the growth was a great deal slower than expected.

In a letter to a stakeholder, CEO Reed Hastings and CFO David Wells write, "Slightly higher prices result in slightly less growth, other things being equal, and this is manifested more clearly in higher adoption markets such as the US. In hindsight, we believe that late Q2 and early Q3 the impact of higher prices appeared to be offset for about two months by the large positive reception to Season Two of Orange is the New Black. We remain happy with the price changes and growth in revenue and will continue to improve our service, with better content, better streaming and better choosing. The effect of slightly higher prices is factored into our Q4 forecast."

In response to why they think they came in lower than expected, Reed and Wells write, "As best we can tell, the primary cause is the slightly higher prices we now have compared to a year ago."

Fourth quarter subscriber projections are expected to come in at 4 million. This would put the revenue at $1.3 billion. Stock also suffers from the anti-equity sentiment at present.